A sole trader is the easiest to set up among all the business structures in Australia. The sole trader tax rate is the same as the individual tax rate. A sole trader’s business income is treated as personal income, and any amount above the tax-free threshold becomes taxable income. Tax payable can be estimated using a sole trader tax calculator in Australia. Learning “how to pay Tax as a sole trader in Australia” is essential for meeting obligations and avoiding ATO penalties.

While a sole trader can choose to self-lodge, the sole trader tax return cost is best reduced with the support of a compliant digital service provider, which helps to avoid issues and ATO penalties. Aupod is the leading name when it comes to affordable tax return service for sole traders in Australia, helping you lodge confidently and efficiently.

Understanding the Sole Trader Tax System in Australia

- The sole trader tax rate and why it’s the same as the individual tax rate.

- The concept of taxable income and the tax-free threshold.

- The role of the Australian Business Number (ABN) and Tax File Number (TFN).

- The purpose of a sole trader tax return and the need for accurate record-keeping.

- How to use a sole trader tax calculator to estimate tax payable.

The Pay-As-You-Go (PAYG) System for Sole Traders

- What PAYG installments are and how they work.

- When a sole trader is required to enter the PAYG system.

- The difference between self-nomination and ATO-calculated installments.

- How to lodge PAYG installments via myGov or with an agent.

- The importance of the Business Activity Statement (BAS) for GST-registered sole traders.

Paying sole trader tax is simple with the ATO’s PAYG (Pay-As-You-Go) instalments system. Sole trader taxes can be paid quarterly, preventing a large tax bill at the end of the financial year.

When starting, sole traders estimate their expected income and nominate an instalment amount to pay every three months. Once the business is established, the ATO bases PAYG installments on the previous year’s income. Payments can be made easily via myGov or with the help of a tax accountant.

If registered for GST or required to make PAYG installments, you may also need to lodge a Business Activity Statement (BAS). BAS reports help sole traders declare and pay obligations like GST, PAYG withholding, and other taxes. Lodging BAS and sole trader tax returns can be done independently, but the risk of missed deadlines or errors often increases the sole trader tax return cost. As a sole trader, you are the sole owner and legally responsible for every part of the business.

That’s where a compliant digital tax and accounting service provider like Aupod makes a difference. Our registered tax agents simplify PAYG installments and BAS lodgements. Enjoy extended tax return lodgement deadlines and competitive pricing, with sole trader services starting from just A$19.

How to Lodge a Sole Trader Tax Return Online

There are two ways to lodge a sole trader tax return in Australia online: through the government online portal or using a registered digital service provider.

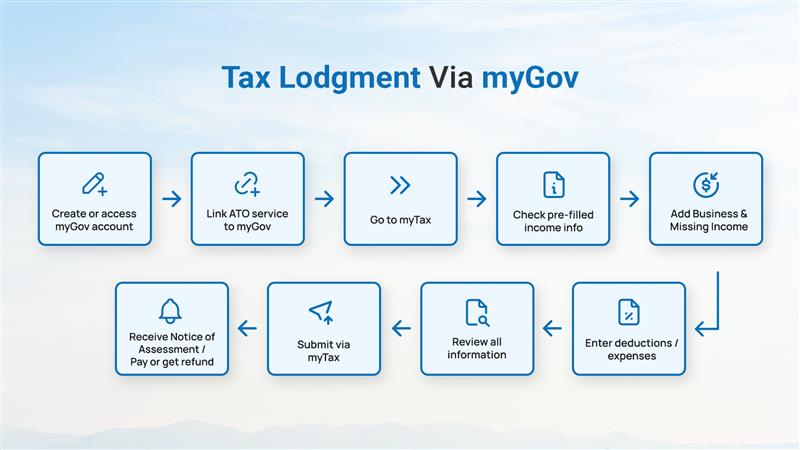

Self-Lodgment Via myTax Method

You prepare and submit your tax return yourself online using myGov/ myTax. It is a good option for anyone whose business finances are straightforward without any complex investments or assets. It lowers the cost but increases risk if errors occur, accurate records are not kept, or tax obligations are missed.

Step 1: Log in and Start

Log in to a myGov account and open the ATO myTax service. The latest individual tax return for the year will appear on the screen. Select Prepare to begin.

Step 2: Check Details

Confirm that personal contact information is correct. If something has changed, click Edit, update the details, and save. Bank account details should also be checked and updated, as any refund is deposited into this account.

Step 3: Residency and Spouse Details

Answer the residency status question by selecting whether the taxpayer is an Australian resident for tax purposes. If unsure, use the ATO residency tool linked in the form. Provide accurate spouse details, as these can affect eligibility for certain offsets or government benefits.

Step 4: Select Business Income

Tick the option stating that the taxpayer was a sole trader or had business income or losses. Leave other options unticked if they do not apply.

Step 5: Identify Business Structure

Choose Business – sole trader income or loss from the dropdown menu. Company, trust, or partnership options remain unselected unless relevant.

Step 6: Personal Services Income (PSI)

The system will ask whether income is classed as Personal Services Income (PSI). Use the PSI decision tool provided to answer correctly. If PSI rules do not apply, select the option for business income or loss. Results can be saved for record-keeping.

Step 7: Business Schedule

Continue to the Business income or loss section. The form may ask about PSI again. If the results test was passed, select Yes. Otherwise, complete the PSI test questions as required.

Step 8: Main Business Activity

Enter the main business or professional activity. Select the option closest to the business type, such as ride-share driver, freelancer, or online retailer. Indicate the number of business activities, the business status (new, ongoing, or ceased), and enter ABN, business name, and address.

Step 9: Income and Expenses

Most sole traders report under “Net non-primary production income,” except those in agriculture or fishing. Enter total business income, then deduct expenses limited to the business-use portion. Common claims include depreciation, software, transaction fees, marketing, and home office costs. Items outside standard categories can be listed under “Other expenses.”

Step 10: Review and Save

After entering income and expenses, myTax will calculate the net business result. Save the section once the figures are correct. Enter zero in mandatory fields that do not apply. If an error appears in red, check the help notes and correct it.

Step 11: Business Losses

Where a business loss occurred, add it in the Losses section. The form will ask how the loss is being claimed. Business loss rules are complex, particularly if PSI applies. In such cases, reviewing the help notes or seeking advice from a registered tax agent is recommended.

Step 12: Final Steps

After completing the business section, proceed to the remaining areas of the individual tax return. These may include Medicare, interest, dividends, capital gains, or employment income. Once all sections are finished, review the return, check the estimate, and lodge it online.

Using a Registered Tax Agent for Your Sole Trader Tax Return

A TPB-registered sole trader tax agent and ATO-compliant DSP can lodge your tax return online. Unlike self-lodgment, using a registered agent with DSP support provides extended deadlines, expert guidance, and peace of mind while reducing errors, avoiding penalties, and managing complex tax obligations efficiently. You can also claim the tax agent fee as a deduction.

What is the Sole Trader Tax Rate 2025?

The sole trader tax rate in 2025 is based on the same progressive income tax rates that apply to individual Australian residents. Sole traders do not pay a separate business tax rate; instead, their business income is treated as personal income. This means the more a sole trader earns, the higher the tax rate applied to the portion of income that falls within each tax bracket.

Sole traders also benefit from the $18,200 tax-free threshold, so no tax is payable until income exceeds the limit.

After deducting eligible business expenses, the taxable income is assessed against the amount that exceeds that amount. Following 2024–25 tax rates (excluding the 2% Medicare levy):

| Taxable Income | Tax Payable |

| $0 – $18,200 | Nil |

| $18,201 – $45,000 | 16c for each $1 over $18,200 |

| $45,001 – $135,000 | $4,288 plus 30c for each $1 over $45,000 |

| $135,001– $190,000 | $31,288 plus 37c for each $1 over $135,000 |

| $190,001 and over | $51,638 plus 45c for each $1 over $190,000 |

Sole Trader Tax Deductions & Obligations

If you operate as a sole trader, or plan to structure your business as one, your main obligations include:

- Lodge with your own Tax File Number (TFN).

- Obtain an Australian Business Number (ABN) and use it for all business activities.

- Report all business income and expenses in your individual tax return.

- Register for GST if your annual turnover is $75,000 or more, or if you provide certain services.

- Lodge Business Activity Statements (BAS) if registered for GST, have PAYG withholding, or make PAYG installments.

- Pay tax on all income, including business income, at your individual tax rate.

- Use PAYG instalments if required, to prepay income tax across the year.

- Claim deductions for eligible personal superannuation contributions.

- Meet the employer and super obligations when hiring workers.

Key Takeaways!

The answer to “how to pay tax as a sole trader in Australia” is simple. It can be self-lodged or can be dealt with the help of a registered tax accountant. The tax rate for sole traders depends on total income above the tax-free threshold. The payable amount can be worked out using an income tax calculator. All tax obligations must be met accurately before lodging the return.

FAQs

When is Sole Trader Income Tax Return Deadline?

The financial year runs from 1 July to 30 June for sole traders. The individual income tax returns deadline is 31 October if self-lodged, unless the ATO specifies otherwise. With a registered tax agent like Aupod, sole traders get an extension on the deadline.

When to Pay PAYG installments?

Most sole traders pay tax in quarterly installments. The ATO issues a BAS or IAS at the end of each quarter, usually due 28 days after. Online lodgment or using a tax agent, sole traders can pay up to three weeks later.

What is the 80% rule for sole traders?

If 80% or more of personal services income comes from a single client (including their associates), the ATO applies the PSI rules and treats the income more like employee income. If less than 80% comes from one client, other business tests (like the unrelated clients test) can be used to show the income is from a genuine business.

How can a sole trader pay less tax in Australia?

Sole traders can bring down their tax amount by claiming business expenses as deductions. Home office expenses, phone, internet, vehicle costs, and equipment used for work are some of the deductions sole traders can claim with a straight record. Super contributions, small business tax offsets, and timing expenses before June 30 can also lower taxable income.