Are you also an employee and looking to save your tax in 2025? No worries Aupod has got you covered with its best tax agents and accounting services fully Complaint with ATO so you can save maximum while paying minimum. Payday should feel rewarding, but for many Australians, it comes with a sting, the moment you notice how much tax has been taken out of your salary. If you’ve ever looked at your payslip and thought, Am I giving away more than I should? You’re not alone.

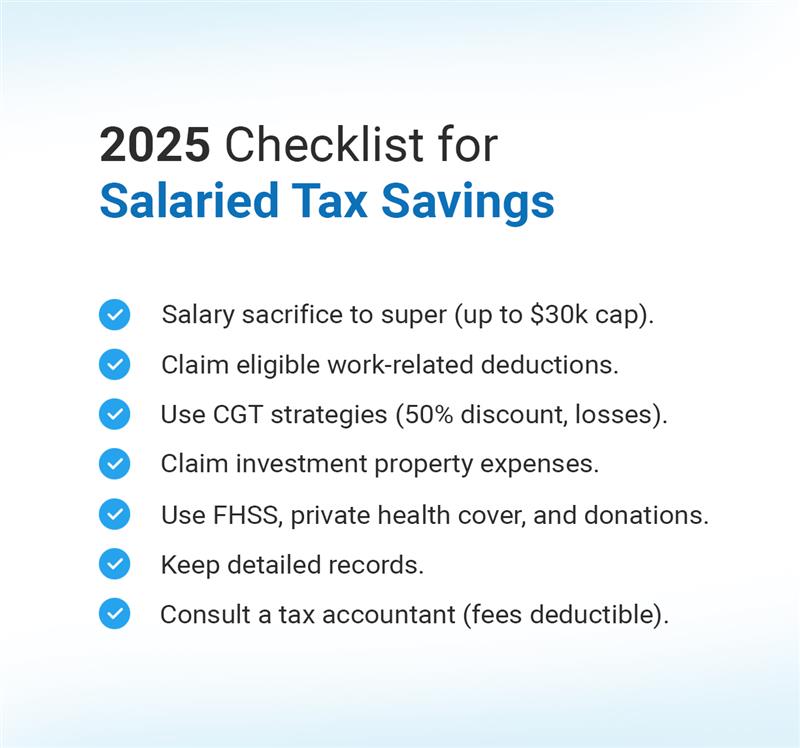

The truth is that thousands of salaried workers in Australia end up paying more tax than necessary simply because they don’t utilize the available strategies. From salary sacrificing into super, to claiming the right work-related deductions, to understanding how investments are taxed, there are clear, legal ways to lower your taxable income.

In 2025, salaried employees in Australia can save tax with the right guidance, and Aupod is here to provide that expert help.

How Salaried Person Income Is Taxed?

In Australia, the more you earn, the higher the percentage of tax you pay. This is called the marginal tax rate. Other than that, everyone pays an extra 2% called the Medicare Levy to help cover healthcare costs. The Medicare Levy Surcharge is an additional cost that high-income employees with no private health insurance have to pay.

The first step in saving money is to figure out which tax bracket you are in. Once you know your tax bracket, you may use clever strategies to move your income to areas with lower tax rates.

How Salaried person or Employees can Save Tax in Australia

Knowing the answer to “how a salaried person can save tax in Australia” can lower the amount of tax you pay on your income.

Salary Sacrifice into Superannuation

One of the best ways for salaried person can save tax in Australia is by using salary sacrifice and making extra contributions to superannuation. If you work for a not-for-profit organization, you may be able to salary sacrifice a large part of your pay. Many bigger companies also let employees salary sacrifice things like cars, laptops, or even school fees.

This option is especially popular among top tier management who save a lot of money through salary sacrificing. Beside, he is building a wealth in form of retirement fund.

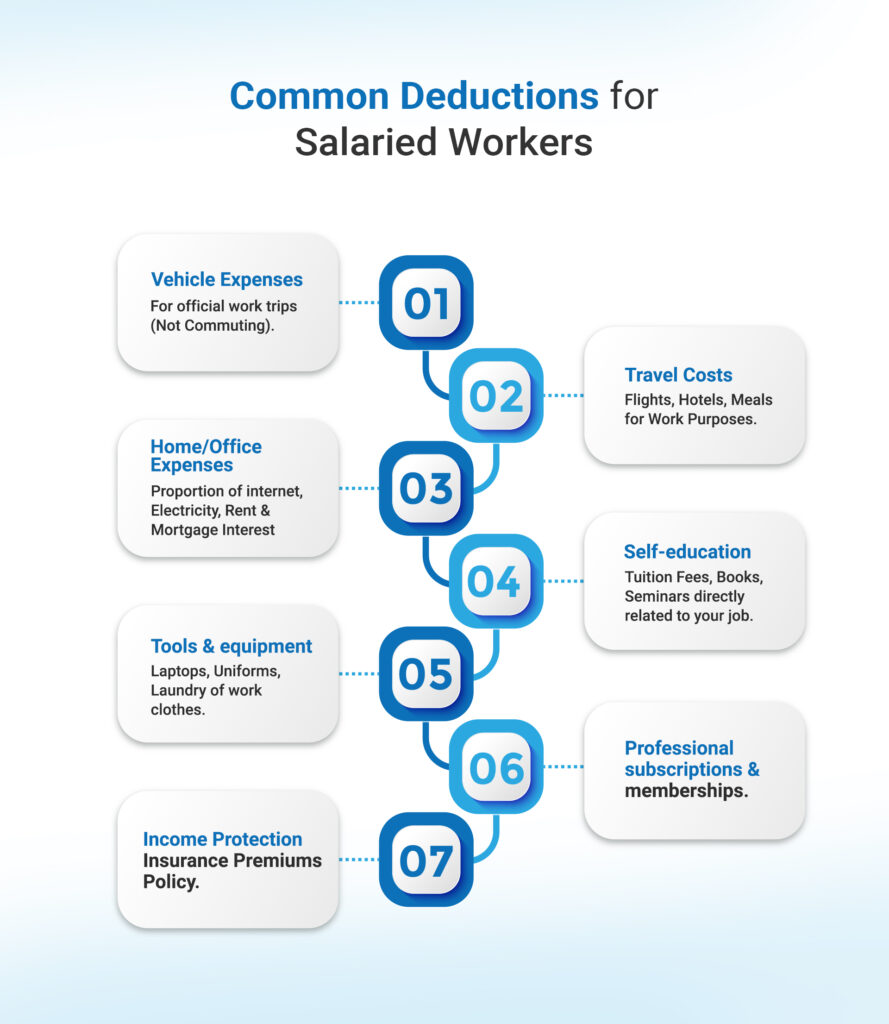

Claim All Work-Related Deductions

Employees can reduce their taxable income by claiming work-related expenses. The ATO allows these deductions as long as the cost is directly connected to earning your income, hasn’t been reimbursed by your employer, and you have records or receipts to prove it.

This means if you spend money on your job and meet these conditions, you can claim it to lower the amount of tax you pay. Up to $300 of deductions can be claimed without written evidence (but expenses must still be legitimate).

Be Smart with Capital Gains (Avoid Wash Sales)

If you have invested in shares or property alongside your salary, the way you manage sales can make a big difference to your tax bill. Holding assets for more than 12 months qualifies you for the 50% capital gains tax discount, meaning you only pay tax on half of your profit. You can also use losses from other investments to offset your gains and lower your taxable income.

Be careful, selling an asset just before June 30 and buying it back immediately, known as a wash sale, is illegal and can trigger an ATO audit. The safest way to reduce tax on investments is to plan sales strategically and avoid shortcuts.

Claim Deductions on Investment Properties

Many salaried employees in Australia invest in rental properties, and these come with generous tax deductions. You may be able to claim negative gearing, which allows you to deduct rental losses from your salary income, reducing your overall tax bill. Property owners can also benefit from depreciation claims, such as wear and tear on appliances (Division 40) and building construction costs (Division 43).

Everyday property expenses, like loan interest, council rates, insurance, repairs, and management fees, can all be deducted. To make the most of these savings, a tax accountant or a qualified quantity surveyor can prepare a depreciation schedule so you don’t miss out on valuable claims.

Cut Down Taxes with Your Side Hustle

It’s common for salaried workers to have a side hustle. If you do, the ATO has special small business concessions that can help reduce tax. For example, you may qualify for the small business income tax offset, worth up to $1,000 per year. You can also use the instant asset write-off to immediately deduct the cost of business equipment or tools under $20,000 if purchased before 30 June 2025.

The simplified depreciation rules make it easier to claim write-offs on eligible assets. Taking advantage of these concessions helps employees with side businesses grow their income while keeping more money in their pockets.

Use Government Incentives

The government offers incentives to help employees save on taxes. If you’re buying your first home, the First Home Super Saver Scheme lets you save up to $15,000 a year (max $50,000) in super and withdraw it later for a deposit with tax benefits.

High-income earners can avoid the Medicare Levy Surcharge by having private health insurance. And don’t forget, donations over $2 to registered charities are tax-deductible.

Get Expert Help to Save Employees’ Tax!

Expert help can simplify your finances and curate an effective strategy on how a salaried person can save tax in Aus. Save tax with confidence, by relying on an Aupod certified professional who helps you;

- Identify overlooked deductions.

- Structure salary sacrifice correctly.

- Advise on super contributions and offsets.

- Make sure you’re 100% ATO-compliant.

Final thoughts

The salaried person in Australia can save tax by employing the right strategies at the right time. It all begins with identifying the tax bracket you fall into. Once you know that with a few simple steps you can lower the amount of tax you have to pay and keep more of your hard-earned pay.

With tax laws changing in 2025, the smartest step is to get expert guidance. Aupod’s registered tax professionals are here to create a simple, step-by-step plan catering to your needs and goals.

FAQs

How to save tax on salary in Australia?

You can save tax on your salary in Australia by making sure you claim all eligible tax deductions and utilize tax-effective strategies. The most common way is to reduce your taxable income, which is the amount of salary you’re taxed on.

Claim All Deductions: Keep records of all work-related expenses like uniforms, home office costs, and professional development courses. These can be claimed on your tax return.

Salary Sacrifice: Direct a portion of your pre-tax income into superannuation, where it’s taxed at a lower concessional rate.

Utilise Tax Offsets: These directly reduce your tax payable. An example is the Low and Middle Income Tax Offset (LMITO), which is applied automatically.

What is the best salary structure to save taxes?

The best salary structure to save taxes often involves salary packaging or salary sacrificing. This is an arrangement with your employer to receive less gross income in exchange for certain benefits. Since the benefits are paid with pre-tax dollars, they reduce your taxable income, which can lower your overall tax bill.

Pre-Tax Benefits: Common items to salary sacrifice include contributions to superannuation, a novated car lease, or a laptop.

Check with Your Employer: Not all employers offer salary packaging, so check what options are available to you.

How do high-income earners reduce taxes Australia?

High-income earners in Australia reduce taxes primarily by using sophisticated strategies that lower their taxable income and take advantage of concessional tax rates. These strategies often involve managing investments and business structures beyond simple deductions.

Superannuation Contributions: High-income earners can make significant concessional contributions to their superannuation, which is taxed at a lower rate than their marginal tax rate.

Capital Gains Tax (CGT) Optimization: By holding assets for over 12 months, individuals can access the 50% CGT discount.

Trusts and Company Structures: Many high-income individuals use trusts to distribute income to family members in lower tax brackets.

How much can you salary sacrifice in Australia?

In Australia, the amount you can salary sacrifice is limited by the concessional contributions cap. For the 2024–25 financial year, this cap is $30,000. This limit includes all before-tax superannuation contributions, such as your employer’s mandatory contributions and any salary sacrifice amounts.

Annual Cap: The concessional contributions cap is $30,000 for the 2024–25 financial year.

Inclusive of Employer Super: Remember that your salary sacrifice contributions are included in this cap along with your employer’s contributions (currently 12% of your ordinary time earnings).