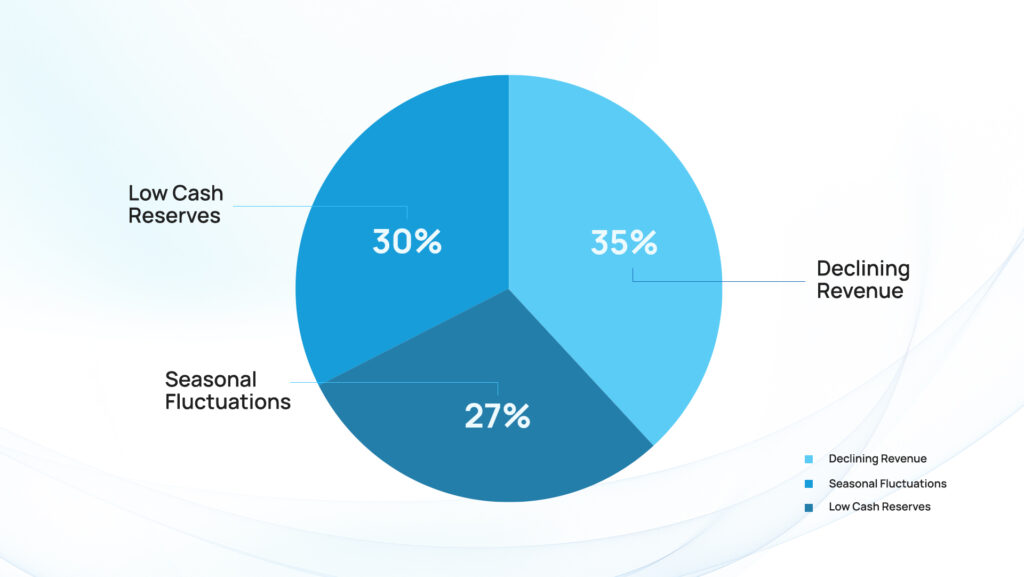

Nearly 80% of Small and Medium-Sized Businesses in Australia (SMBs) experience cash flow problems, which can also disrupt the ATO tax return. The studies show the most common causes of cash flow problems are:

- Declining revenue- 35%

- Seasonal fluctuations-27%

- Low cash reserves- 30%

| What is Cash Flow? “It is the net movement of funds into and out of a business over a defined period.” How is Cash Flow Calculated? Total Cash Inflow-Total Cash Outflow |

Businesses and freelance workers are better equipped to maintain profitability, execute strategic investments, and in agile decisions with a solid cash flow. Inadequate cash flow management impedes growth and undermines trust by causing missed ATO compliance deadlines, delayed payments, and liquidity problems.

In this guide, you will explore 10 powerful hacks that help you (business and freelancers) stay liquid, stress less, and keep your business moving forward.

4 Challenges of Maintaining a Cash Flow for Freelancers and Business Owners

The road to visibility is not without hurdles when maintaining healthy cash flow, especially for freelancers and small business owners who are exploring multiple responsibilities. Read 4 challenges that are not letting you get on the edge:

1. Managing Payments

The major challenge for businesses is to balance two things:

- When to bill

- How to collect.

Some businesses invoice post-service, while others rely on upfront payments to stay liquid. Delayed processing over 30 days can disrupt planning and payroll cycles. There are digital tools that automate billing and offer instant payment options that can ease the burden.

2. Managing Receivables

Businesses that deliver services promptly but wait weeks or even months for payment lack reinvestment opportunities, stall operational spending, and the ability to lodge business tax returns on time. If a business implements clear payment terms and automated reminders, it can have fewer delays.

3. Accessing Capital

Securing funds during a cash crunch can be problematic, even increasing the rate of loan rejection. In bootstrapped environments, growth plans stall and day-to-day operations become harder to sustain without sufficient working capital. Proactive financial planning and reliable accounting advice improve credit readiness.

4. Employee Management

Payroll is one of the first pressure points when cash flow stalls. It can lead to missed paydays, affecting the staff morale, besides damaging the employer’s brand. Payment delays trigger resignations, disrupting project delivery and client trust. Cash buffers maintain workforce stability and business continuity.

Cash Flow Techniques for Businesses and Freelancers

Apart from day-to-day challenges, businesses and freelancers lack survival and growth. Here are 10 essential strategies for each path that will help you stay financially steady, no matter how you work:

1. Prioritise Cash Flow

Profit is a long-term indicator, and cash flow is the daily reality. Profitable businesses collapse when cash isn’t available in the hour of need. Healthy cash flow is possible with weekly financial position tracking and studying early trends by a tax return accountant or accounting and tax services. This way, businesses and freelancers can stay ahead of shortfalls and mitigate the reliance on emergency funding in line with ATO compliance. In a nutshell, “healthy cash flow is the foundation for sustainable growth.”

2. Prompt Invoicing

Delayed Invoicing=Delayed Cash

ATO-approved Digital Service Provider platforms, like Aupod, help keep businesses and individuals on track with automated invoice systems. The payment terms, due dates, and late fees are mentioned, reducing the chances of disputes. Faster invoicing smooths the operations.

3. Strategic Bill Payments

When you pay bills early, it reduces your liquidity. Businesses should take advantage of full payment terms, for example, hold cash for 30 days unless early payment incentives make sense. This strategic approach increases your flexibility and provides you with breathing room for expected costs and opportunities with smart timing.

4. Build a Cash Reserve

Every business needs to set aside a percentage of profits regularly to create a reserve. It can cover 3-6 months of operating costs. The fund you put aside protects you during downturns, delayed payments and economic shocks. Even small contributions, made consistently, add up over time and give confidence while navigating uncertainty.

5. Smart Cost Cutting

Spending without setting a limit drains the business’s financial reserves quickly. The solution is to review expenses periodically for the non-essential outflows and limit the bloated overheads. Contract renegotiation, selective outsourcing, and substituting affordable tools for high-end ones are the answers. Saving every possible dollar extends the cash runway and supports long-term resilience.

6. Real-Time Tracking

Manual spreadsheets are error-prone, while a modern accounting system provides you with the cash flow visibility for making data-backed decisions. Visibility also provides forecasting, automated alerts, and transaction categorisation that make things easier. Businesses need this tech-driven insight to help avoid blind spots and keep financial strategy aligned with their operations.

7. Seasonal Planning

Freelance gig workers and small businesses experiencing revenue peaks and troughs can stay ahead with planning. They can save surplus cash from spikes and rely on credit lines and short-term financing to smooth out lean months. New product lines and exploring new markets also reduce seasonality.

8. Simplify Collections

Late payments are a common pressure point for both freelancers and small businesses, disrupting cash flow and delaying obligations like BAS and payroll. Automated invoicing and reminder schedules reduce the risk of overlooked payments and improve consistency. Payment terms clearly communicated and consistently enforced result in a predictable collections process — supporting better cash planning and stronger client relationships.

9. Use Short-Term Finance Wisely

Short-term financing is not a sign of weakness — it’s a strategic tool when used correctly. Invoice financing, merchant advances, or business credit lines can bridge temporary gaps. Always assess repayment terms and ensure financing aligns with projected cash inflows. The goal is liquidity, not long-term debt dependency.

10. Claim Grants and Incentives

Government grants and tax incentives can significantly ease financial pressure without adding debt. Programs like Australia’s R&D Tax Incentive reward innovation and reinvestment. Stay informed about available schemes, maintain accurate records, and work with an advisor to maximise eligibility. Free capital is the smartest capital.

Conclusion!

Many freelancers and small businesses focus on growth without acknowledging the importance of effective cash flow. It can result in challenges like maintaining the employees, financial instability and sometimes even in the liquidity of assets. Freelancers managing unpredictable gigs or businesses struggling with payroll, suppliers, and tax obligations, staying liquid is non-negotiable.

Hacks like getting professional help from a recognised ATO-approved DSP like Aupod sustain stability and unlock growth backed by the right tools, strategies, and expert advice. Gain confidence with the cash flow clarity and keep your business moving forward.