There are approximately 164,172 small businesses in Australia, which make up 98% of all businesses. These are important for the economic wealth, and the four most common structures are;

- Sole trader

- Companies

- Partnerships

- Trusts

While they drive growth and contribute significantly to the country’s economic wealth, managing costs and maximising profits remains a constant challenge. One smart way to strengthen financial outcomes is by claiming all eligible business tax deductions.

Aupod helps your businesses thrive by identifying every eligible deduction and keeping it in your pocket to reinvest in business operation expansion.

What are the General Business Tax Deductions Rules?

Deductions are the costs is the cost subtracted from your income. This lowers your taxable income. The lower your taxable income, the less tax you pay.

Keeping good records helps you claim all the deductions you’re entitled to. Most business expenses are tax-deductible.

The ATO has three golden rules for valid business owner tax deductions:

- If an expense is part business and part personal, only claim the business portion. This is called apportioning.

- The expense must be for your business, not personal use.

- You must keep records to prove your claim.

What Business Tax Deductions Can You Claim?

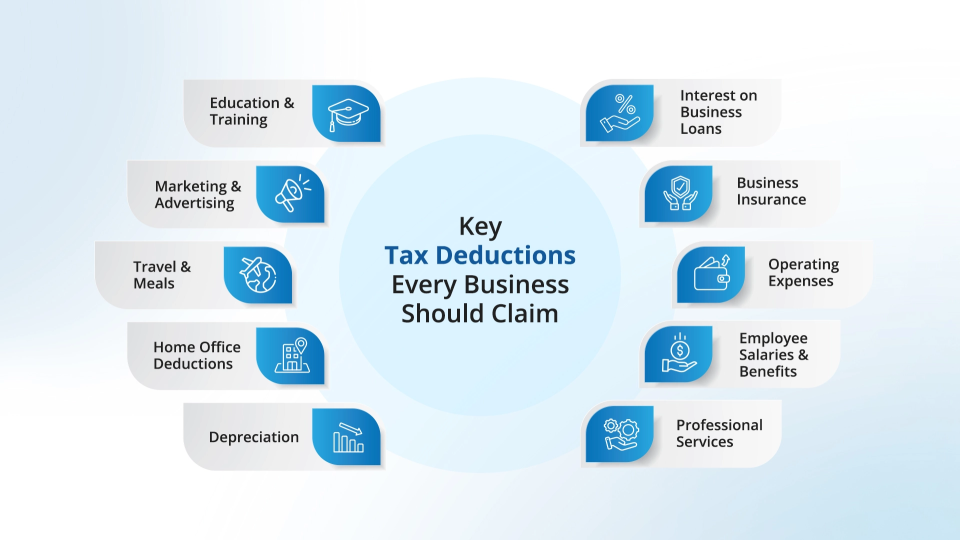

You can claim tax deductions for most business expenses that help you earn income. Common deductible expenses include:

- Day-to-day operating costs

- Purchases of products or services for your business

- Capital expenses, such as machinery and equipment that lose value over time

The amount you can claim depends on the type of expense. For example, some capital costs are deductible over several years. If part of an expense is private, you must reduce your claim. Some costs, like fines, are not deductible.

You cannot claim the GST part of an expense if you are already claiming it as a GST credit on your BAS.

You can also claim expenses to protect staff from health risks at work. Examples include masks, gloves, sanitiser, sneeze guards, wipes, and cleaning supplies.

What Business Tax Deductions Can’t You Claim?

Some business expenses are not tax-deductible. These include:

- Entertainment costs, unless provided as a fringe benefit.

- Traffic fines.

- Private or domestic costs, such as childcare fees or family clothing.

- Expenses linked to income that is not taxable.

- Payments where you did not meet PAYG withholding or reporting obligations (non-compliant payments).

- The GST portion of a purchase if you already claim it as a GST credit on your BAS.

You also cannot usually claim the cost of capital assets covered under capital gains tax rules, such as land for business premises. Exceptions apply for capital works, plant, or certain improvements made by primary producers.

If your income is classed as personal services income (PSI), some deductions may also be limited under PSI rules.

How to Claim Business Tax Deductions?

Your business tax deductions claim depends on your business type.

- A sole trader can claim deductions in their individual tax return under the Business and professional items schedule. You can use myTax or a registered tax agent.

- Partnership can claim deductions on the partnership tax return.

- The company can claim deductions on the company tax return.

- Trust can claim deductions on the trust tax return.

Final Words!

The small business in Australia makes up a vast majority of all kinds of businesses run in the country. They get benefits like claiming the deduction that they incur in operationalising, be it day to day cost of monetary investment on services for business purposes. There are still limitations on claiming small business tax deductions, like if any device is used for both business and personal purposes, only the amount used for business can be claimed.

Aupod helps your business stay ATO-compliant while maximising your tax savings by

- Keep accurate records for at least five years

- Separate business and personal expenses clearly

- Claim only valid and documented deductions

- Stay on top of BAS, PAYG, and annual tax return deadlines

Turn every receipt into a refund booster with Aupod by your side. Start your business tax journey by booking a free consultation.

FAQs

Do businesses have to pay taxes?

Businesses in Australia have to pay tax based on their business structure. Sole traders pay personal tax rates, whereas partnerships transfer income to partners who are taxed individually. Trusts either transfer money to beneficiaries or pay the highest tax rate if it is not distributed. Companies pay directly from profits, which is typically 25% for smaller enterprises and 30% for bigger ones, in addition to other responsibilities like GST, PAYG, and superannuation.

When is business tax time?

Australian business owners have to pay tax of the previous fiscal year between July 1 to October 31. The self-lodgment deadline is October 31, and businesses that hire a licensed tax agent receive additional time, but they must register with the agency before October 31. Along with annual tax filings, many businesses are required to submit BAS and PAYG payments throughout the year.

How do I get or find my business Tax File Number (TFN)?

A Tax File Number (TFN) is a unique number the ATO uses to identify your business for tax purposes. How you get or find it depends on your business structure. Sole traders use their individual TFN, which they already have. Partnerships, trusts, and companies need a separate TFN, which you apply for through the Australian Business Register (ABR) when setting up your business