Aupod | Simplified Tax & Accounting for Individuals & Businesses in Australia

Sole Trader Tax Returns Made Simple, Fully Compliant, and Completely Stress-Free.

Lodge with Aupod’s registered tax agents. No upfront payment – fee payable from your refund. Get maximum deductions and peace of mind with professional ATO-compliant lodgements.

Registered Tax Agents

ATO Compliant

5-Star Client Support

ATO-compliant lodgements

GST & BAS management

Maximised deductions

Year-round support

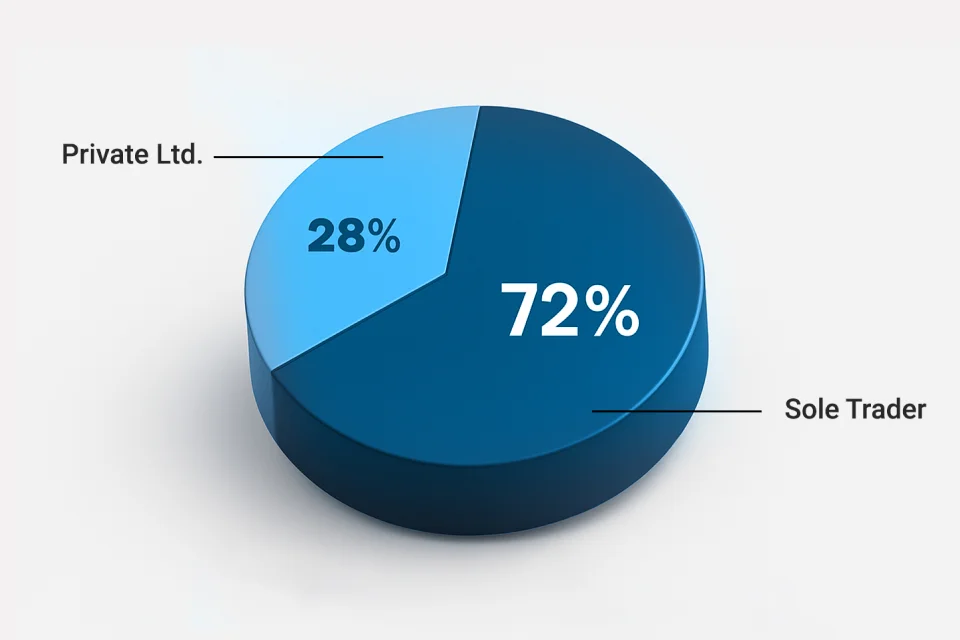

Running a Sole Trader Business in Australia

A sole trader manages the business independently, making all decisions and retaining full control of profits. It is the simplest and most cost-effective structure in Australia, but it comes with personal liability, as personal assets are connected to business debts. Unlike companies or partnerships, there is no legal separation.

Every sole trader needs an Australian Business Number (ABN) to trade and invoice clients, while the Tax File Number (TFN) is used to lodge the annual individual tax return. The ATO can also place sole traders in the PAYG instalment system to help manage future tax obligations.

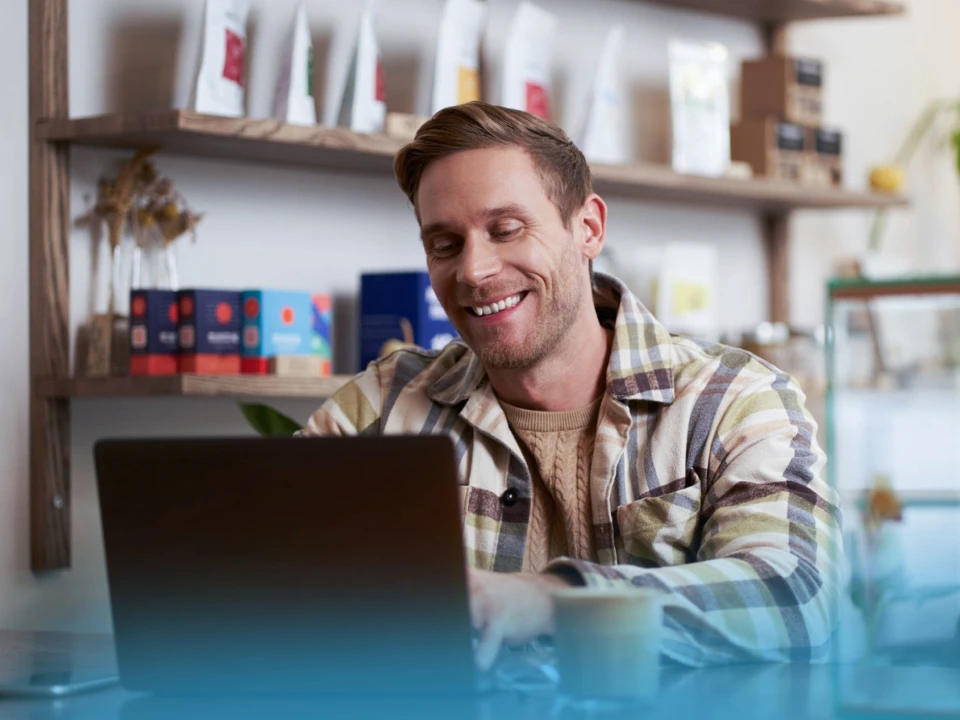

Sole Trader Tax Return Services with Aupod

Running a business as a sole trader is rewarding, but staying compliant with the ATO can be complex. That’s where Aupod steps in. Our registered tax accountants provide end-to-end support designed to keep tax simple, accurate, and stress-free.

Tax return preparation & lodgement

GST registration & BAS management

PAYG instalment advice

Record-keeping and compliance support

Personalised tax planning to maximise deductions

Guidance with audits & ATO queries

Sole traders get clarity, compliance, and confidence in every tax return with Aupod services.

Straightforward Sole Traders' Tax Solutions

Australian sole traders’ tax obligations can be complex, with frequent changes to income tax brackets, GST rules, and business concessions. Small errors, overlooking deductions, misreporting BAS, or poor record-keeping can result in ATO penalties or audits.

Opportunities to reduce tax, from home office costs and vehicle expenses, to the instant asset write-off, are missed. With professional guidance from Aupod’s registered tax agents, sole traders can

Stay compliant

Avoid costly mistakes

Claim every eligible deduction

Maximise tax refund

Sole Trader Tax Deductions and Credits

Sole traders claim expenses directly related to running the business. Eligible deductions include electricity, phone, internet, software, rent, and professional services. Home-based businesses claim a portion of running costs such as power and equipment depreciation.

Business use of cars, tools, and equipment qualifies as a deduction, either through an immediate write-off or depreciation over time. Sole traders claim personal superannuation contributions made to a complying fund to reduce taxable income.

Industry groups also allow specific deductions, tradies claim protective clothing and tools, while creatives claim specialised equipment and resources used to generate income.

Advanced Tax Planning for Sole Traders

A sole trader business thrives on smart financial planning. With the right strategies, it’s possible to unlock real savings and prepare for long-term growth. This includes income planning to reduce tax, claiming instant asset write-offs on new tools or equipment, and receiving tailored advice on when to shift from a sole trader to a company structure. Add strategic super contributions and well-timed expenses, and the benefits multiply quickly.

With Aupod’s registered tax agents, every approach remains fully ATO-compliant, helping sole traders cut tax, protect profits, and build a stronger financial future.

Getting Your Sole Trader Tax Return Sorted

Book

Share

Lodge

A sole trader business thrives on smart financial planning. With the right strategies, it’s possible to unlock real savings and prepare for long-term growth. This includes income planning to reduce tax, claiming instant asset write-offs on new tools or equipment, and receiving tailored advice on when to shift from a sole trader to a company structure. Add strategic super contributions and well-timed expenses, and the benefits multiply quickly.

With Aupod’s registered tax agents, every approach remains fully ATO-compliant, helping sole traders cut tax, protect profits, and build a stronger financial future.

Frequent Asked Questions

What happens if I miss the tax return deadline?

Missing the deadline can lead to failure-to-lodge penalties and interest charges from the ATO. Late lodgement may also increase the risk of compliance reviews or audits.

Can I lodge my own tax return as a sole trader?

Yes, sole traders lodge an individual tax return using myTax, or they can use a registered tax agent for professional support and extended deadlines.

How does GST affect my tax return?

If annual GST turnover exceeds $75,000, registration is required. GST collected and paid is reported in the Business Activity Statement (BAS), not in the income tax return.

What if I had no income this financial year?

A tax return still needs to be lodged if registered as a sole trader. If no income was earned, a nil return or non-lodgement advice may be required.

How can I claim my business expenses?

Business expenses directly related to earning income, such as rent, phone, internet, vehicle costs, tools, or home office expenses that are claimed in the Business and Professional Items section of the return.