Are you an employee in Australia trying to figure out which tax deductions you’re eligible for?

Tax time in Australia means collecting all the receipts, finding out what you can actually claim, and what not. Navigating tax season in Australia is simple, especially with a TPB-certified tax agent like at Aupods, which totally understands what you can legitimately claim to help maximize your after-tax income, without unwanted scrutiny from the ATO.

| What are Tax Deductions for Employees in Australia? Employees can claim a deduction at the time of submitting their tax return for expenses incurred while working. These deductions can lower the total tax you pay. Income – deduction = total tax paid Tax deductions vary depending on the nature of your employment, but many remain the same across most occupations. |

Tax Deductions for Employees Rules

ATO is very clear about what tax deductions salaried employees in Australia can claim, and regarding the specific deductions, the fundamentals are:

- You must have incurred the expense yourself.

- Your employer cannot reimburse the expense.

- You need proper records, such as receipts, invoices, or statements.

- It must be directly related to earning your employment income.

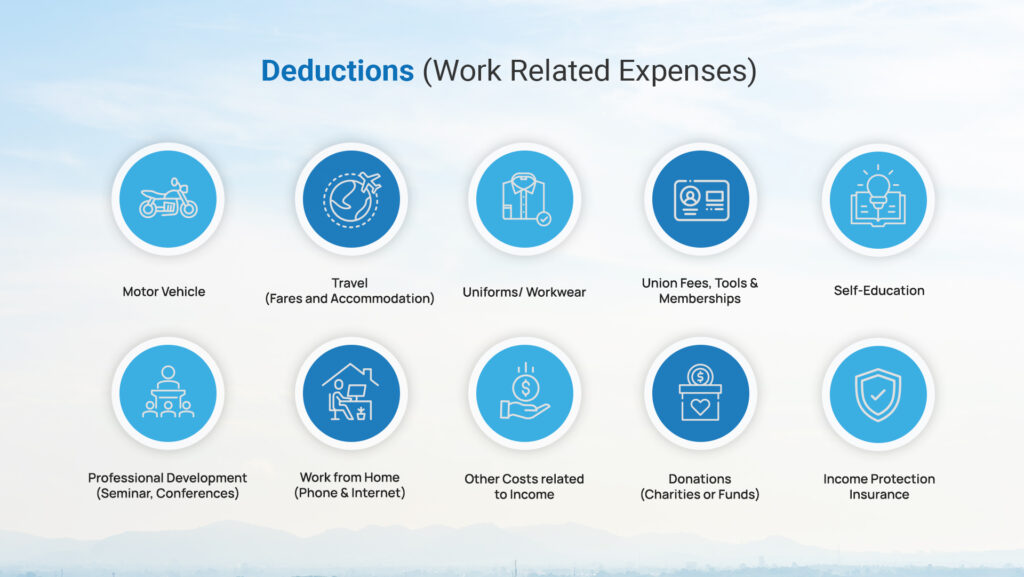

List of Tax Deductions for Salaried Employees in Australia?

The Australian Taxation Office (ATO) provides a detailed list of deductions that salaried employees can claim at tax time. These also include work-related expenses that salaried employees in Australia can claim as tax deductions. We’ve made a simple list of the deductions you can claim at tax time, so you don’t miss out on getting back the money you deserve.

Work-Related Vehicle & Travel Expenses

You can’t claim the cost of going from home to work every day. But if your job makes you travel to different places for work, you can claim things like car costs, a hotel stay, or meals when you sleep away from home.

Protective & Occupation-specific Clothing

You can claim clothes that have your work logo or are part of a uniform your boss makes you wear. You can also claim special clothes for your job, like a chef’s pants or safety boots. If you need protective gear, like sunscreen or safety shoes for outdoor work, that counts too

Working from Home Expenses

If you work from home, you can claim things like your phone and internet bills expenses in tax deductions in Australia. You can also claim stuff you use for work, like pens, paper, or printer ink. Part of your power bill can be claimed too, because you’re using electricity while working. If you buy small office items under $300, you can claim them right away, but bigger things have to be claimed a little at a time.

Phone and Internet Usage

If you use your own phone or internet for work, you can only claim the part that you actually use for work in work-related deductions in Australia. You need to show proof, like bills or a record of how much was used for work.

Professional Memberships & Fees

Subscriptions to trade associations, union fees, or professional accreditation costs are mostly deductible if related to your job.

Gifts and Donations

Some gifts and donations can help lower your tax, but only if they follow the ATO rules. For example, donations are deductible if you give them to a special group called a Deductible Gift Recipient (DGR). The gift has to be real, not something you get a reward back for, and it must be $2 or more with a receipt. You can even spread some donations over a few years.

People often ask things like ‘are gifts for employees tax deductible’ or ‘are gift cards for employees tax deductible’. The answer is “NO”. Buying gifts for employees, gym memberships for employees, or buying lunch for employees usually counts as a work benefit, not a donation. Even Christmas gifts for employees tax deductible is a separate rule, because that’s about staff benefits, not charity.

Gym Memberships & Fitness-related Costs

In general, gym and fitness-related costs are not deductible, even if you believe they help your job performance. Exceptions are extremely rare and apply only if your role requires an exceptionally high level of physical fitness (e.g., trapeze artist, physical training instructor).

Gifts for Employees (Employer Perspective)

Although the focus here is on employees, it’s worth noting employers can deduct non-entertainment gifts under $300 (including GST) with no Fringe Benefits Tax (FBT). Gifts over $300 attract FBT and still may be deductible.

Self-Education and Professional Development

You can claim study costs at tax time if they are linked to your job and help you get better at it. This can include things like paying for classes, buying textbooks, going to work-related conferences, or traveling for study. If you buy study equipment that costs more than $300, you can claim it a little bit at a time. You can also claim some home office costs if you study at home for your job.”

Tools & Equipment

You can claim small work items that cost less than $300, like simple tools or gadgets. If something is more expensive, you can still claim it, but only a part of the cost each year (this is called depreciation). You can also claim the cost of fixing or insuring your work tools. Even work-related COVID-19 tests, masks, gloves, or hand sanitisers can be claimed as tax deductions.

Tax Agent Fees & Managing Your Tax Affairs

Fees for tax agents or accountants, including travel to consultations, are deductible in the year after payment. It is best to take help from a reliable tax service provider like Aupod, who can help you maximise your tax refund and shortlist every deduction you can claim.

Beware of Dubious Claims

The ATO uses smart tools to check what people claim at tax time. Some things are not allowed and will get rejected, and are a straight no to what can I claim tax in Australia?

- Yachts or boats

- Pilates or gym classes (unless your job needs it, like a trainer)

- Grocery bills

- Normal everyday clothes

Work-related Deductions in Australia at a Glance

| Deduction Type | Eligible? | Notes |

| Vehicle & Travel (work-related) | Not commuting | |

| Uniforms & Protective Clothing | Must be specific or required | |

| Home Office & Consumables | Fixed rate or real costs | |

| Phone & Internet | Partial | Only work-related portion |

| Professional Subscriptions | Work-related only | |

| Gifts & Donations (DGR) | Must be $2+, genuine gift | |

| Gym Memberships | Rarely | Only for high-stamina jobs |

| Self-Education Costs | Must relate to current job | |

| Tools & Equipment | Under $300 or depreciated | |

| Tax Agent Fees | For the next year after paying |

The Next Steps

Only claim things you really spent money on and can prove with receipts. Every deduction should be clearly for work, written down properly, and fair. If you’re not sure what to claim, it’s smart to talk to a registered tax agent. For example, if you’re looking for the best tax agent Sydney or need help with tax return assistance, Aupod is here to guide you.

Let Aupod’s expert tax accountants make tax time stress-free while helping you get the biggest refund you deserve. Book Your Free Consultation!